Hi from Sonja Rae on a Wednesday “hump” day, lol… This is also officially my FIRST original content “blog post” as RIA-CCO. My goal is to keep it light, and informative. Compliance is kind of “dull” to some, but I’m not, so let’s do this!

I found this article in FA Magazine informative and it supported my thoughts.

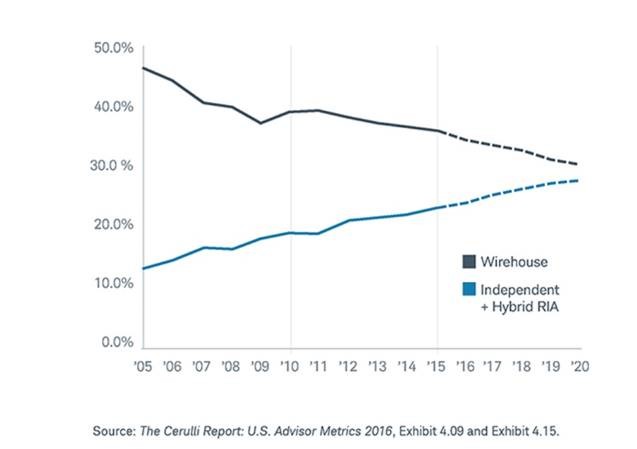

As a general rule, the states regulate Registered Investment Advisors which have under $100M in AUM, and the SEC regulates them when they are above the $100Mil AUM threshold. To me, this generally points to the smaller firms, and typically less experienced advisors being regulated at the state level. Also, more than ever, there are Financial Advisors leaving wire-houses and moving towards starting their own RIA (trend graph below). A broker-dealer has much more stringent compliance and licensing requirements than the RIA space, and starting an RIA requires (in my opinion) very little capital and licensure.

All of these things considered, I am happy to hear state regulators are “stepping it up”! I just finished an audit with the State of Colorado for an RIA and it was very in-depth.

Cheers from Sonja Rae @ RIA-CCO

View the full article here.